Happy New Year

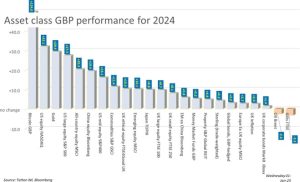

Next week, we will bring you a full account of asset class performance for December and for 2024. In the meantime, we show various asset classes (some of which overlap each other), so readers can get an idea of which areas did best and worst.

December had a number of market-moving events – like the Fed blowing a proverbial big raspberry at markets just before Christmas. While these had a sting in the tail, they did not disrupt the impressive rally for US stocks in 2024 overall. The party was not ruined; it just ended quietly after many participants headed home early. In sterling terms, December ended with slight gains, and most equity markets showed either small gains or small losses.

Over the course of 2024, markets had already grown increasingly positive about US economic growth. US market commentators were generally in a buoyant mood, albeit with brief periods of doubt. Since Trump’s November election victory, the narrative has turned somewhat optimistically one-sided: there will be tax cuts, but the government will become ultra-efficient and the budget deficit will be slashed. The favourite market narrative since then has been that deregulation will quickly bring about another burst of growth and profitability.

The ‘soft’ confidence indicators have been strong and backed by reasonably firm retail sales data, but other ‘hard’ activity data has been less positive. This has been the case in the US throughout 2024, but the difference has widened again since the election. It’s reasonable that the American public should have high expectations for what can be achieved. However, it also means that they will want to see that their confidence is well-founded and that there will be swift and effective action after January 20th.

This is where first doubts seem to be creeping in, given that in the Trump coalition, the ultra-conservatives and the ‘tech-bros’ of Musk & co have quite different aims and intended outcomes. During their time in opposition with the Democrats, they could exist within the same camp. But they are direct opponents on some issues – as the row over skilled immigration visas last week shows – and that could create frictions in government.

We and many investors are keen to know how Trump deals (or does not deal) with this spat. His campaign always had few specifics, which meant that one could hope for the best possible outcome without having to know how the potentially conflicting aims might be balanced. Now, inevitably, we are fast approaching the point of reality. That may mean some of the optimism is dented.

Notably, investors have in almost diametric opposition, been getting gloomier about the current situation and prospects for Europe and the UK. There are many reasons for that gloom, but we think the biggest handicap continues to be the relative cost of energy across Europe. Incidentally, that could improve rapidly – or the opposite.

With Russia now halting all gas pipeline deliveries through Ukraine, near-term gas prices have spiked back up to 12-month highs. The continued deliveries since 2022 have benefitted European nations closest to Russia; Austria, Hungary and Slovakia. However, the halt is not being portrayed as a consequence of Russia’s policy but, rather, as a result of Ukraine’s actions.

European relations are becoming more fractured, while Russia’s negotiating position is strengthened ahead of any dialogue after Trump’s presidency begins. Perhaps we should see this as a near-term tactic rather than a longer-term one, a signal that Russia expects an end to fighting this year. If so, gas price rises might prove temporary, with Europe’s prospects looking brighter after what was a dismal 2024.

Sterling has begun the year on a downbeat note, having had a quite positive run through 2024. Gilt yields and interest rate expectations remain relatively elevated, so the move seems a little odd. However, Q3 real GDP data was revised down to show no growth, taking away the small +0.1% gain previously estimated.

Commentators are vying to be pessimistic about growth for 2025 and yet also say that wage inflation will remain substantially stronger than elsewhere because the country’s population is indolent, and the government is loading taxation on employment costs. In this scenario, the Labour government would have to expand the fiscal deficit further, which will make Gilts look even more unattractive.

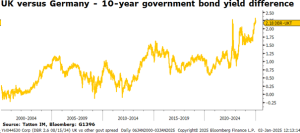

Against this backdrop, UK bonds have reached an interesting point. The premium gap between UK yield and German government yields is at the widest in 25 years, as the chart below shows:

Yet the UK’s narrative is not so different to Europe’s. At some point, the spread differential will be wide enough to compensate for those specific fears. If UK yields can retrace some of the recent gains, that should also help more domestically-focussed stocks.

Looking across the professional and social media New Year’s commentary, one could gain the impression that 2025 turning for the worse is a foregone and generally accepted conclusion. Yet, as 2024’s gloomy predictions proved to investors, one needs to be careful not to let such spurious insights guide the decision making process.

2025 starts with more big forces in play than usual and we know little about how this will evolve a month ahead, yet alone a whole year ahead. Hopefully, the world will move along the narrow path to a more peaceful and sustainable global environment that will provide positive underpinnings for consistent 2025 investment returns.

Click here to download the commentary